CCP Client 'CO330'

Global Manufacturer of Electronic Assemblies

Clayton Capital Partners is pleased to exclusively represent CO330 (the “Company”) in the sale of its business. Headquartered in the Midwest, CO330 is an end-to-end product design, development, engineering, and manufacturing firm.

Fully Integrated Partner – CO330 offers its customers one source for product design, product engineering, and ISO-certified manufacturing. End-to-end integration (from prototype to manufacture to management of supply chain services) enables CO330 to offer customers the cost, quality and speed-to-market benefits that single-function firms cannot.

Significant Growth Opportunities – CO330 has initiated a two-part growth strategy designed to increase both revenues and the number of customers. Through organic growth, and growth through acquisition, the Company has created a solid base from which to exploit its excess capacity and therefore drastically increase the size of its business.Over the past five years, the Company has acquired firms with expertise in imaging and optical processing, motor controls and sensors.

- Global Engineering, Design, Manufacturing

- and Global Supply Chain Firm

- 145+ Engineers Worldwide

- Value-Added Services

| CO330 Financial Highlights | |||||||||||||

| Core Business | |||||||||||||

| Internal Year Ending 12/31/2018 |

Internal Year Ending 12/31/2019 |

Internal Year Ending 12/31/2020 |

Internal Year Ending 12/31/2021 |

Internal Year Ending 12/31/2022 |

Preliminary Year Ending 12/31/2023 |

Forecast Year Ending 12/31/2024 |

|||||||

|

Net Sales

|

$84,916,496 | $195,322,313 | $61,010,471 | $94,172,957 | $97,222,427 | $115,637,729 | $115,482,983 | ||||||

| Gross Margin % | 30% | 33% | 33% | 33% | 35% | 38% | 37% | ||||||

|

Adjusted EBITDA

|

$12,888,471 | $46,662,893 | $2,050,694 | $8,565,527 | $9,235,210 | $17,354,535 | $15,109,043 | ||||||

| CO330 Financial Highlights | |||||||||||||

| Acquisition I | |||||||||||||

| Internal Year Ending 12/31/2018* |

Internal Year Ending 12/31/2019* |

Internal Year Ending 12/31/2020* |

Internal Year Ending 12/31/2021 |

Internal Year Ending 12/31/2022 |

Preliminary Year Ending 12/31/2023 |

Forecast Year Ending 12/31/2024 |

|||||||

|

Net Sales

|

$34,310,541 | $35,712,300 | $36,134,300 | $46,968,438 | $26,322,677 | $21,244,479 | $36,118,291 | ||||||

| Gross Margin % | 22% | 22% | 24% | 16% | 11% | 8% | 20% | ||||||

|

Adjusted EBITDA

|

$2,317,276 | $1,846,800 | $2,301,700 | $2,918,847 | $(2,086,867) | $(3,553,371) | $1,218,625 | ||||||

|

*CO330 made this acquisition (I) on December 1, 2020. |

|||||||||||||

For clarity, the term “core business” represents all of CO330’s operations except acquisition H and acquisition I. Refer to the Confidential Information Memorandum for further details.

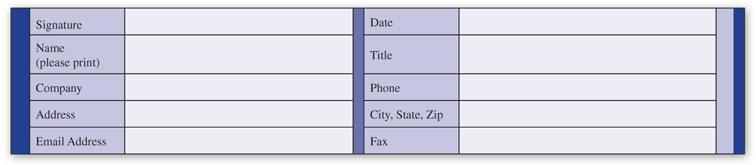

The undersigned hereby agrees:

That all information, data and materials disclosed or furnished (herein called the Information) by Clayton Capital Partners Acquisition Candidate CO330 (herein called the Company) will be maintained strictly confidential and that, in consideration for such disclosure, no use of the Information will be made by any signing party, or employees of such party, other than for evaluation purposes, on a strictly confidential basis.

It is understood that disclosure of any of the Information, including the possibility that the Shareholders may consider sale, disclosure of the current status of the Company, or disclosure of any information to customers, vendors, competitors, or employees of the Company would cause serious financial damage to the Company and/or its affiliates.

The undersigned also agrees that, for the term of this agreement, they will not solicit for employment any management-level employee, executive-level employee, or any employee of the Company with whom the undersigned came into contact with as a result of the proposed transaction. Nothing herein shall preclude the undersigned from hiring any employee who responds to a general solicitation so long as it is not targeted at the Company or its employees (including through the use of search firms) or who contacts the undersigned of their own accord.

The undersigned agrees not to copy, duplicate, disclose or deliver all or any portion of the Information to a third party or permit any other third party to inspect, copy or duplicate the same except those parties deemed necessary by the undersigned to evaluate the possible transaction (including agents, advisors, affiliates, accountants, attorneys, consultants, and lenders). It is understood that the undersigned may disclose Information to only parties who (i) require such material for the purpose of evaluating a possible transaction and (ii) are informed by the undersigned of the confidential nature of the Information and agree to be bound by the terms hereof. The undersigned further agrees to be responsible for any breach of this agreement by the above mentioned parties, and that these parties will not use any of the Information for any reason or purpose other than to evaluate a possible transaction or in any way detrimental to the Company.

This shall not, however, prevent the undersigned from disclosing to others or using in any manner:

- Information which has been published and has become part of the public domain other than by acts or omissions by the receiving party

- Information which has been furnished or made known to the undersigned by third parties as a matter of right without restriction of disclosure

- Information which the undersigned can show was already in its possession at the time it entered into this Agreement and which was not acquired directly or indirectly from the Company, their representatives, its employees or their representatives, or

- Information which is independently developed by the undersigned or its representatives.

This agreement shall remain in effect for a term of two years from the execution date hereof and upon request, the receiving party will promptly return or destroy all data and materials furnished by the Company and destroy any internal analyses and/or workpapers related to the evaluation of the Company. The undersigned shall be permitted to retain copies of Information for the sole purpose of complying with applicable laws and not be required to destroy electronic Information saved for backup and bonafide record retention policies in the ordinary course of business. Any such retained Information shall remain subject to the confidentiality obligations of this agreement for so long as such information is retained.

|

||||||||||||||